P-EBT for Retailers

Pandemic Electronic Benefit Transfer (P-EBT) is part of the U.S. government response to the COVID-19 pandemic. The Families First Coronavirus Response Act of 2020 (PL 116–127), as amended by the Continuing Appropriations Act, 2021 and Other Extensions Act (PL 116-159), provides the Secretary of Agriculture authority to approve state agency plans to administer P-EBT.

Through P-EBT, eligible school children receive temporary emergency nutrition benefits loaded on EBT cards that are used to purchase food.

Electronic Benefits Transfer (EBT) is an electronic system that enables a person to transfer their benefits from a Federal account to a retailer’s account to pay for eligible food. All authorized SNAP stores must use EBT equipment and transaction services.

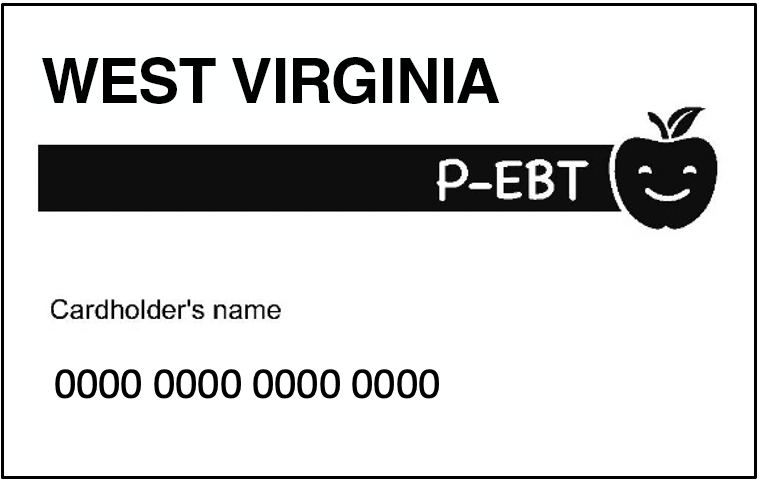

Retailers should expect customers to have additional food benefits to spend using the West Virginia PEBT card.

Accepting PEBT benefits and FNS Certification

To accept any SNAP benefits, including P-EBT, retailers need FNS certification. The state of West Virginia is not involved in the FNS application and merchant certification. However, we are happy to answer questions and provide guidance. You can find more information at www.dhhr.wv.gov/ebt

FNS works with qualified stores (also known as retailers) to

- Certify the store to accept SNAP benefits,

- Monitor SNAP stores to ensure they follow Program rules,

- Withdraw or disqualify SNAP stores that have broken the rules or no longer qualify to accept SNAP benefits.

Use the interactive map to locate other retailers in your area.

If your store is not currently approved to accept SNAP, review the general requirements to find out if your store might be eligible. Training materials, which explain Program rules and requirements, are available for you to review as well. Familiarize yourself with how SNAP benefits can be used, then apply to accept benefits: https://www.fns.usda.gov/snap/apply-to-accept

Applying to become a SNAP retailer is an important decision. FNS works closely with retailers to fight fraud and to limit the errors retailers may make through lack of training, attention to basic instructions, or poor supervision. These errors could result in losing your permit or facing more severe penalties.

All certified merchants will need to obtain point of sale equipment ask their current ACH processor if the current point of sale equipment can be configured to accept EBT benefits. The state EBT transactions are processed by Fidelity Information Services, LLC (FIS). For newly certified merchants who need an EBT processor, FIS is one option. There are other Third-party processors that can also provide EBT transaction support. Each merchant is responsible obtaining EBT point of sale equipment.

If you have any questions, contact the SNAP Retailer Service Center at 1-877-823-4369.

On Nov. 4, 2020, the Food and Nutrition Service (FNS) published the Supplemental Nutrition Assistance Program: Pandemic Electronic Benefits Transfer (P-EBT) Integrity Final Rule, which is codified at 7 CFR 284.1. This rule requires FNS to treat P-EBT benefits the same as SNAP benefits for the purposes of identifying and sanctioning Program violators.

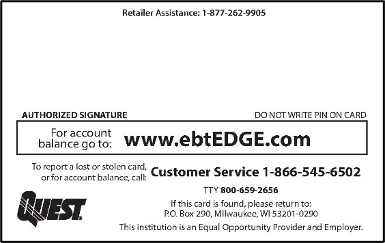

What is Pandemic Electronic Benefits Transfer (P-EBT)? P-EBT is part of the U.S. government response to the COVID-19 pandemic and was established by the Families First Coronavirus Response Act (FFCRA). P-EBT provides benefits – very similar to SNAP benefits — to children that would have received free or reduced-price school meals, if not for COVID-related school closures and/or COVID-related reductions in school hours or attendance. For most households, P-EBT benefits were loaded onto SNAP cards, so retailers will not notice any difference between P-EBT and SNAP benefits. For the School Year 2020-2021, P-EBT benefits were loaded onto new cards that do not look like SNAP cards but work the same. Retailers must treat P-EBT benefits and households the same as SNAP benefits and households.

How can P-EBT benefits be used? P-EBT households can use their benefits at SNAP-authorized retailers, to purchase eligible foods (i.e., the same foods that can be purchased with SNAP benefits).

What are prohibited activities (i.e., program violations) in P-EBT? What are the penalties for these violations? Per Section 284.1 of the SNAP regulations, P-EBT violations, and penalties for committing such violations, are the same as SNAP violations and penalties. You can review the SNAP retailer training materials here: https://www.fns.usda.gov/snap/retailer/training. Briefly, P-EBT violations include, but are not limited to:

- Trafficking: Buying or selling P-EBT benefits for cash. The penalties for trafficking include permanent disqualification, forfeiture of property, and/or a monetary penalty for each violation.

- Selling ineligible items: Selling cigarettes, tobacco, alcohol, or expensive nonfood items for P-EBT benefits may result in a 3- to 5-year disqualification or equivalent civil money penalty.

- Selling common ineligible items like detergent or paper products for P-EBT benefits may result in a 6-month to 3-year disqualification or equivalent civil money penalty.

Quick links for Retailers

West Virginia Office of EBT Banking Services website – www.dhhr.wv.gov/ebt

USDA Food and Nutrition website – How Do I Apply to Accept Benefits?

USDA Food and Nutrition website – Is My Store Eligible?

USDA Food and Nutrition website – SNAP Retailer Service Center